CENTRALIZED EXCHANGE FAILURES CONTINUE TO HIGHLIGHT POWER OF SELF-CUSTODY

CONTEXT IS KEY

The self-inflicted implosion of FTX, the second largest centralized cryptoasset exchange in the world, continues to send shock waves throughout the traditional financial and cryptoasset markets weeks after knowledge of the massive the fraud hit the public realm.

For the uninitiated, this failure appears to be the beginning of the end of any legitimate future for the cryptoasset industry. The unfortunate reality is that these catastrophic failures of centralized exchanges are an all too common occurrence and market veterans have the scars to prove it.

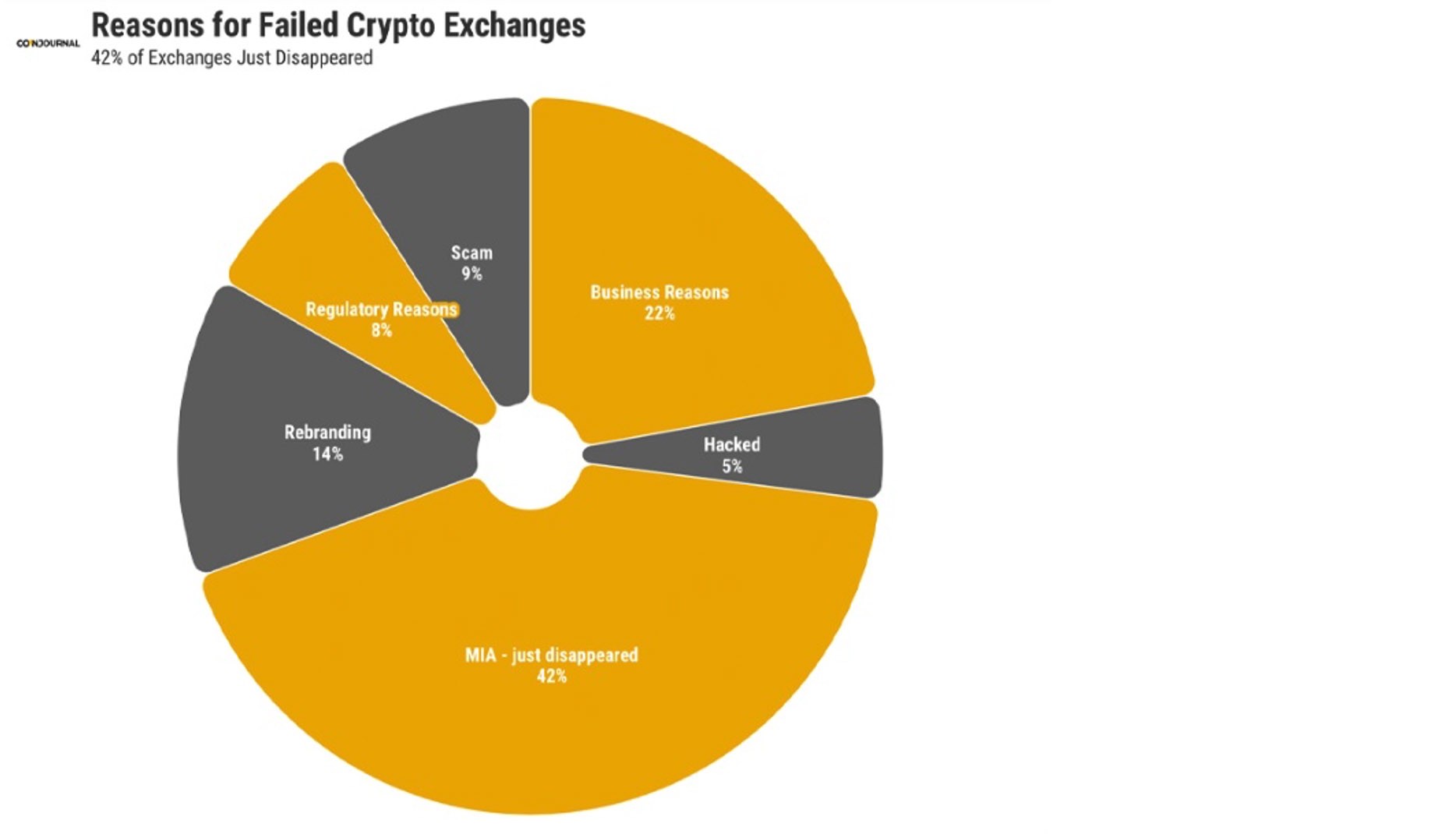

According to CoinJournal, the number of defunct exchanges surged 252% in 2019 and increased another 17% in 2020 before a much needed decrease of 52% in 2021. Astonishingly, 42% of the failed centralized exchanges disappeared overnight with little or no information provided to their customers. To be clear, the unaccountable structure of these entities was a feature, not a bug, and there are many centralized exchanges that operate in the same manner today.

This past market context provided is not intended to minimize the intentional fraud that allowed FTX to grow into a global player seemingly overnight. In fact, the high profile failure of FTX possesses unique characteristics in a trend of centralized failures given its astonishing reach into the traditional financial market.

For example, Temasek Holdings Limited, a holding company owned by the Government of Singapore with $403 Billion assets under management, recently announced its intention to write off its $275M investment in FTX. American financial institutions dove in as well with Sequoia Capital also announcing writing off its $175M investment. In all, around 80 investors put up around $2B into FTX over two years according to the New York Times.

BITCOIN NOT CRYPTO

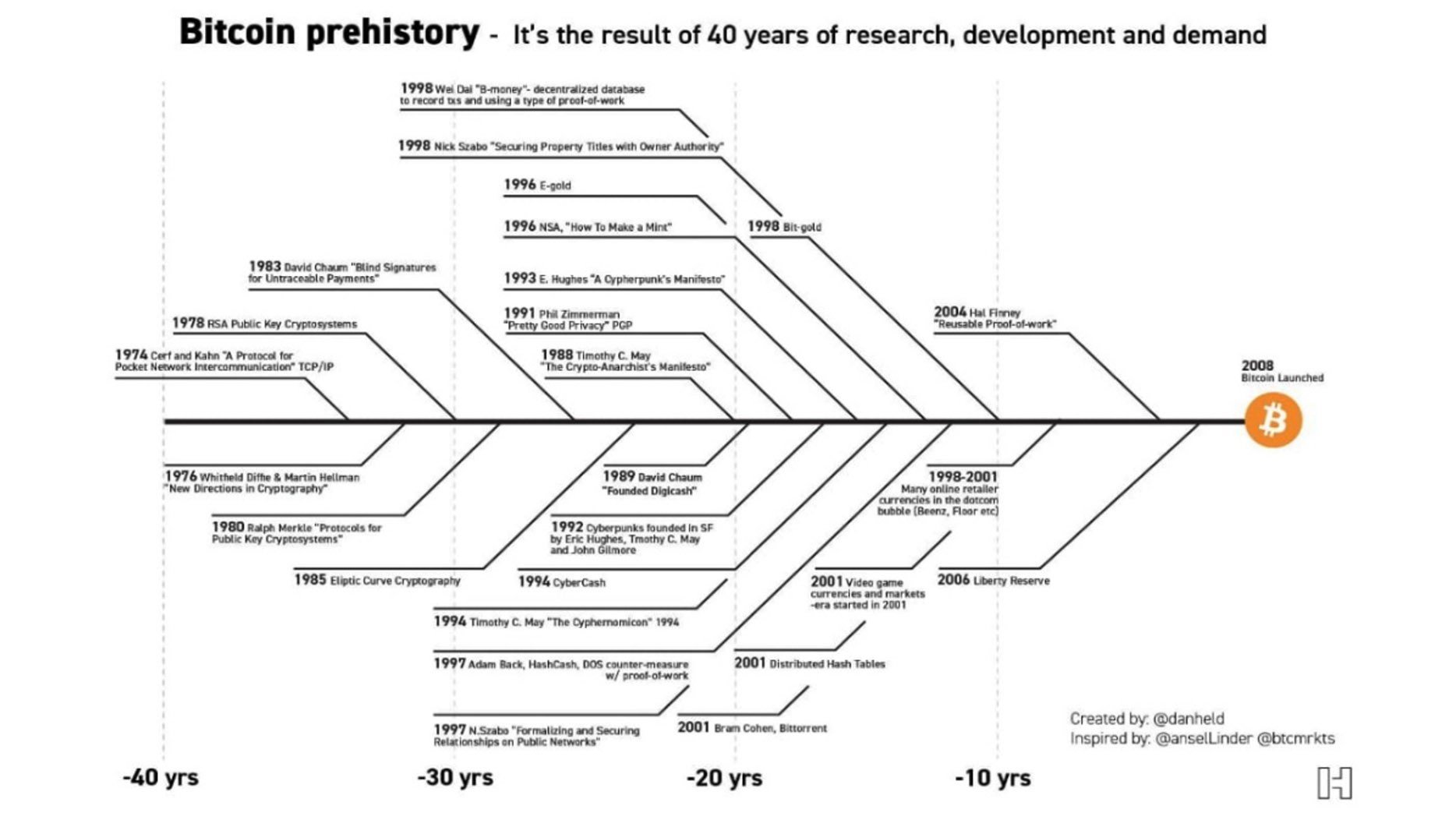

It is important to understand that the failure of a centralized exchange like FTX does not equate to the failure of a decentralized commodity like Bitcoin, a truly unique technology that is the direct result of 40 years of research, development and demand. It is a trustless, permissonless and immutable technology that empowers individuals to quickly transfer value through time and space for a fraction of the cost compared to centralized options available today.

Despite past, current and future market fluctuations, nothing has changed with Bitcoin’s underlying open source protocol since the genesis block was mined on January 3, 2009 by someone only known as Satoshi Nakamoto on messaging boards. It has been operating nearly flawlessly with an up time of a 99.986% uptime without a CEO, a board of directors or any “hacks.” Interestingly, Bitcoin was launched during similar uncertain financial times we face today with a message within the raw data reading, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

It can be argued that centralized exchanges are an oxymoron to a commodity like Bitcoin. The vast majority of centralized exchanges that exist today operate outside of the United States by design and tempt new customers by offering unsustainable high yields, irresponsible leverage (sometimes up to 125X) and countless airdrops of useless Blockchain tokens designed to evoke FOMO (fear of missing out) on the next “Bitcoin.” Unfortunately for those that fall for the temptation, the music eventually stops and there are not enough chairs to go around for everyone to have a seat.

Not surprisingly, centralized exchange failures like FTX, have a direct impact on market behavior. Indeed, the more knowledge individuals gain about Bitcoin, the less they trust third parties with it. According to Glassnode.com, customers have been withdrawing Bitcoin to self-custody wallets at a rate of 106,000 Bitcoins a month since the collapse of FTX—a rate only seen three other times in Bitcoin’s history. This reaction demonstrates that more and more individuals continue to educate themselves on the power of self-custody and truly owning one’s assets. As the saying goes, “Not your keys, not your coins.”

REGULATORY-FIRST APPROACH IS CRITICAL

Bad facts make for bad laws. Congress must resist the urge to respond to frauds like FTX with sweeping legislation and regulations that stifle opportunities for legitimate, innovative technologies. While reasonable minds can disagree on the specifics of properly regulating the industry, if at all, it is critical policymakers understand the difference between truly decentralized technologies like Bitcoin and other centralized securities disguised as decentralized commodities. While it may appear to be a nuanced distinction, successfully separating the two from a regulatory lens provides an opportunity for Bitcoin and other blockchain technologies to reach their full potential that could improve lives around the world.

Recently, U.S. Securities and Exchange (SEC) Chair Gary Gensler reiterated the SEC’s past position that Bitcoin is a commodity due to its truly decentralized nature. He also doubled down on the agency’s position that other crypto financial assets possess the hallmark attributes of a security under the Howey Test. Unfortunately, the SEC continues to interact with the industry from an enforcement-first approach rather than regulatory-first approach. Doing so catches a fraction of bad actors while dissuading good actors from entering or fulling investing in the industry.

While the full fallout from the FTX fraud remains to be seen, it is clear the lack of clear guidance from US regulators continues to empower nefarious actors to meet demand while stifling ingenuity.

Author: Justin Swanson, Bose McKinney & Evans LLP, Leader of the MI Blockchain & Cryptocurrency Practice Group